It is there any feature option to choose different VAT values depending on the product that a vendor is selling?

For example there are products that have different VAT rates.

For example selling food has let say vat rate 9%, selling clothes has VAT rate 19%, selling books has 5%. and the same seller (in one country) is selling all of these. How we do in this case?

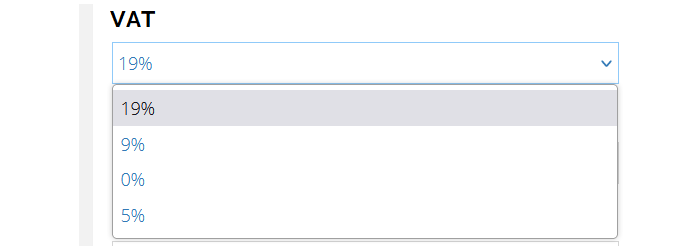

Would be good to have an option to set up the VAT rates and display on product page something like in the image bellow, and to be a default value which is used most. Could be a default value per vendor

Vendors do always have a choice to define which taxes apply to their products.

Unless I misunderstood your case - if I did, please clarify what kind of effect do you want to achieve.

Best regards,

Robert

Where you can set/add multiple VAT rates to display as you mentioned?

I can see just you can add one /per country/zone

I found, I was expecting to add once VAT and set up VAT rate using " * Tax rates" TAB to mention multiple value. I had to add multiple records for VAT

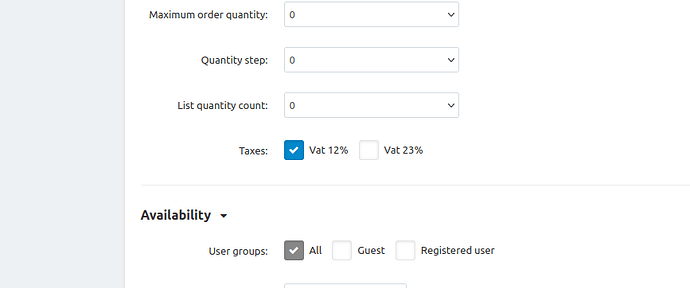

@soft-solid @CS-Cart_team when we use multiple VAT rates the option cs cart has with checkbox is not proper and gives errors/issues.

More precisely let say we have product A and Product B and Vat rates 12% and VAT rate 23%.

When I edit product A I can choose both VAT rate for same products namely 12% and 23% which is not correct from accounting perspective.

User should have option to choose only one VAT rate /product.

@CS-Cart_team what happens If I have chosen 2 VAT rates for same product which one will be used? Please use a drop down list instead of a check box for VAT rate option

Hello gurdji

Different countries may have different types of taxes and there may be many of them. That’s why they are a checkbox and you can impose multiple taxes on the product.

Best regards

Robert

@soft-solid can you name a country and a product or product type/categories that have multiple VAT rates? And how are applied these multiple rates on same product?

Hello

I am not writing about VAT, but other taxes, surcharges, etc.

Best regards

Robert

Robert from @soft-solid is correct. Different countries may have different taxes. So for example, customers from different countries in EU may have different taxation.

- there are many VAT rates but one product has one VAT rate

- other taxes, surcharges that are mentioned by @soft-solid are not product related, but order related

It doesn’t necessarily have to work in this way.

Taxes in CS-Cart are assigned to products, shipping methods and payment surcharges. There is no tax for order.

So, I’m afraid, there won’t be any changes in the nearest future on this case.

My view is to have separated taxes of products from other taxes namely

- shipping methods taxes

- payment surcharges

- order taxes

You can try to find a third party modification from our certified developers:

https://marketplace.cs-cart.com/developers-catalog.html?services=MD

Or contact them to develop such one for your store.

You can achieve this for the first two categories by creating different tax rates e.g. shipping-tax and tick that for a given shipping method, product-tax and tick that on relevant products.

The surcharge is a little tricker because presumably that is not reliant on a product but you could create a tax called my_surcharge and assign it to a hidden product and that is about as much thought as I have given it but maybe make that hidden product a required product, or part of product bundle or promos … without knowing why you are trying to do what you are trying to do I don’t know if any of those will work for you.